Coleman D. Ross

Education Course Requirements

or Topics Covered

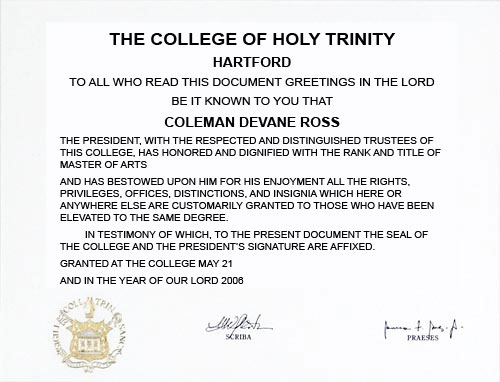

Master of Arts

Major in Economics

In the long run, we are all dead. Economists set themselves too easy, too useless a task if in the tempestuous seasons they can only tell us that when the storm is long past the ocean will be flat.

— John Maynard Keynes

[Economics is] not a 'gay science', I should say, like some we have heard of, no, a dreary, desolate and, indeed, quite abject and distressing one; what we may call, by way of eminence, the dismal science.

— Thomas Carlyle

Trinity College chapel

photo by Andrew Ross

I enrolled in the Trinity College Master of Arts program in economics in 1999, both because of my interest in higher learning in economics and finance and the quality of Trinity as an institution. While my study was interrupted by returning to work one year later, I resumed my studies at Trinity in 2004 and completed the program with a concentration in corporate finance in May 2006. The program required the completion of ten credit courses for 30 semester hours and an additional three-hour noncredit course. My course work follows:

- Basic Economic Principles (noncredit course)

- Microeconomic Theory

- Macroeconomic Theory

- Financial Accounting Valuation and Measurement

- Corporation Finance

- Portfolio Management

- Analysis of Financial Markets

- Econometrics

- Methods of Research

- Derivative Securities

- Pension and Other Postretirement Benefits: Accounting Myth

and Economic Reality (research project)

It is not from the benevolence of the butcher, the brewer, or the baker that we expect our dinner, but from their regard to their own interest. We address ourselves, not to their humanity but to their self-love, and never talk to them of our own necessities but of their advantages.

As every individual, therefore, endeavours as much as he can both to employ his capital in the support of domestic industry, and so to direct that industry that its produce may be of the greatest value; every individual necessarily labours to render the annual value of society as great as he can. He generally, indeed, neither intends to promote the public interest, nor knows how much he is promoting it. By preferring the support of domestic to that of foreign industry, he intends only his own security; and by directing that industry in such a manner as its produce may be of the greatest value, he intends only his own gain, and he is in this, as in many other cases, led by an invisible hand to promote an end which was no part of his intention. Nor is it always the worse for society that it was no part of it. By pursuing his own interest he frequently promotes that of society more effectually than when he really intends to promote it. I have never known much good done by those who affected to trade for the public good. It is an affectation, indeed, not very common among merchants, and very few words need be employed in dissuading them from it.

— Adam Smith, Inquiry into the Nature and Causes of the Wealth of Nations

(back to the Education main page)

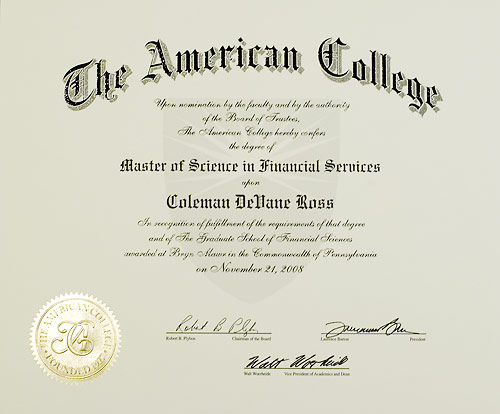

Master of Science in Financial Services

One quarter of Americans think that buying lottery tickets is a better retirement plan than saving or investing.

— The New York Times (May 14, 2000)

The American College's Gregg Conference Center

photo from The American College

![]() I enrolled in the Master

of Science in Financial Services degree program at the Richard

D. Irwin Graduate School of The American College in 2002 while

I was still the CFO of The Phoenix, both because of my interest

in financial services and the blend of residency courses and

independent study courses offered by the college. The program

required the completion of twelve credit courses (36 semester

hours) and one noncredit

course. I

completed the program and received my degree in 2008.

I enrolled in the Master

of Science in Financial Services degree program at the Richard

D. Irwin Graduate School of The American College in 2002 while

I was still the CFO of The Phoenix, both because of my interest

in financial services and the blend of residency courses and

independent study courses offered by the college. The program

required the completion of twelve credit courses (36 semester

hours) and one noncredit

course. I

completed the program and received my degree in 2008.

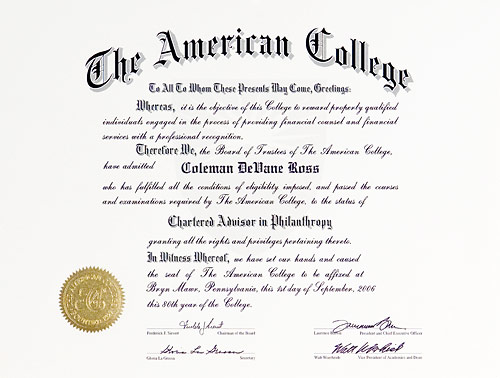

![]() While enrolled in The American College’s MSFS program,

I also completed the school’s Chartered

Advisor in Philanthropy (CAP) designation and

its Charitable Planning and Financial

Asset Management programs. The CAP designation and

related program required me to complete three charitable giving

courses (nine semester hours) and meet experience and ethics

requirements. The asset management program required me to also

complete three courses in asset management (nine semester

hours). I started the CAP program in 2003, both as an adjunct

to my MSFS studies and to support fundraising efforts on behalf

of the Boy Scouts of America. I completed the last examiniation

in July 2006 and received the desigation in September 2006.

While enrolled in The American College’s MSFS program,

I also completed the school’s Chartered

Advisor in Philanthropy (CAP) designation and

its Charitable Planning and Financial

Asset Management programs. The CAP designation and

related program required me to complete three charitable giving

courses (nine semester hours) and meet experience and ethics

requirements. The asset management program required me to also

complete three courses in asset management (nine semester

hours). I started the CAP program in 2003, both as an adjunct

to my MSFS studies and to support fundraising efforts on behalf

of the Boy Scouts of America. I completed the last examiniation

in July 2006 and received the desigation in September 2006.

Courses for these programs follow:

Master of Science in Financial Services and

Certificate in Financial

Asset Management

- Communications and Research (noncredit course)

- Financial Statement Analysis

- Managing the Financial Services Enterprise

- Financial Institutions

- Security Analysis and Portfolio Management

- Retirement Savings Plans for Employees

- Advanced Estate Planning I

- Personal Tax Planning

- Mutual Funds: Analysis, Allocation, and Performance Evaluation

- Ethics and Human Values

- Charitable Giving

- Executive Compensation

- Charitable Giving Applications

Chartered Advisor in Philanthropy Designation and

Certificate in Charitable Planning

- Charitable Giving

- Charitable Giving Applications

- Charitable Giving: Managing the Tools,

the Applications, and the Relationships

"Come in!" [said the Professor]

"Only the tailor, Sir, with your little bill," said a meek voice outside the door.

"Ah, well, I can soon settle this business," the Professor said to the children, "if you'll just wait a minute. How much is it, this year, my man?" The tailor had come in while he was speaking.

"Well, it's been a doubling so many years, you see," the tailor replied a little gruffly, "and I think I’d like the money now. It's two thousand pounds, it is!"

"Oh, that's nothing!" the Professor carelessly remarked, feeling in his pocket, as if he always carried that amount with him. "But wouldn't you like to wait just another year, and make it four thousand? Just think how rich you'd be! Why you might even be a King, if you liked!"

"I don't know as I'd care to be a King," the man said thoughtfully. "But it dew sound a powerful sight o' money! Well, I think I'll wait –"

"Of course you will!" said the Professor. "There's good sense in you, I see. Good-day to you, my man!"

"Will you ever have to pay him that four thousand pounds?" [one of the children] asked as the door closed on the departing creditor.

"Never, my child!" the Professor replied emphatically. "He'll go on doubling it, till he dies. You see it's always worth while waiting another year, to get twice as much money!"

— Lewis Carroll, Sylvie and Bruno

(back to the Education main page)

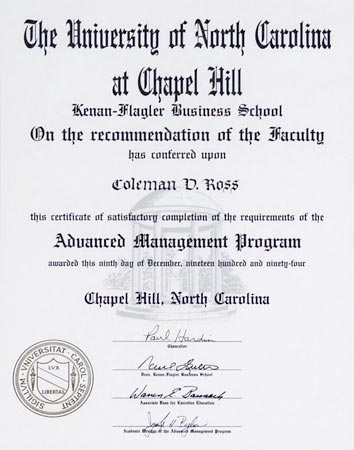

Advanced Management Program

Alumni of the University of North Carolina can be a puzzle sometimes. We graduate and go our separate ways and spend the rest of our lives repeating to our friends and families those fond memories we all acquire. We fix the time spent in Chapel Hill in a special section in our minds. And so we never leave and can always come home again. And when we do come home, for a reunion, to watch a son or daughter graduate, or just by chance, we wander with nostalgia down the old brick paths, across the still green grasses, beneath the poplars and along the stone walls we can never forget and whisper to one another, "I don't recognize the place".

— Sam J. Ervin, Jr. (UNC Class of 1917 and U.S. Senator from North Carolina)

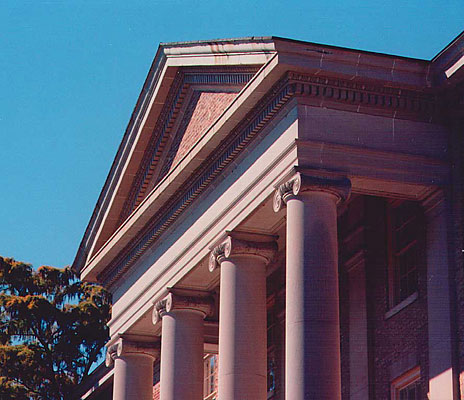

The University of North Carolina, South Building

photo by Andrew Ross

I completed the University of North Carolina Kenan-Flagler Business School Advanced Management Program in 1994. Price Waterhouse provided executive education opportunities to practice leaders and nominated me for the program because of my leadership role with the firm's insurance practice and my concurrent role as the engagement partner for the recently demutualized The Equitable Companies. I was pleased to have this opportunity to return to Chapel Hill and participate. The program involved four one-week sessions over four months and focused on leadership and management, covering the following topics:

- Financial Accounting

- Activity Based Cost Accounting

- International Business

- Shareholder Value Creation

- Strategic Information Systems

- Strategy Implementation

- Management Simulation

- Life-long Goal Setting

- Team Building

- Leadership Philosophy and Challenges

- Leadership Styles

- Global Strategy Development

- Marketing Strategy

- Operations Management

- High Performance Workplace Creation

With Dick Jenrette at his Charleston home

overlooking the harbor

and Fort Sumter.

Photo by Carol Ross

Carol and Coleman Ross with Dick Jenrette at Roper House, Charleston.

Photo courtesy of Kenan-Flagler Business School

[There are] also some useful management lessons to be learned … particularly how to survive under stress…. I [recall] a quotation used by Albert Camus: "the dogs bark, but the caravan moves on." In conversations and communications with Equitable people, I sought to portray these almost daily irritations [media sniping, credit-rating agencies' threatened downgrades, regulators' delays, and competitors' bashing] as being akin to jackals snapping at the heels of the camels in the caravan. The important point is not to let the caravan stop and try to fight it out with the dogs. Rather one must keep the caravan moving. I reminded our people that we knew precisely where our caravan was going – to the promised land of demutualization with an oasis containing [capital] at which we could refuel and quench our thirst. We just had to keep the caravan moving and not slow down.

— Richard H. Jenrette

(UNC Class of 1951

and Retired CEO, The Equitable Companies)

Jenrette: The Contrarian Manager

(back to the Education main page)

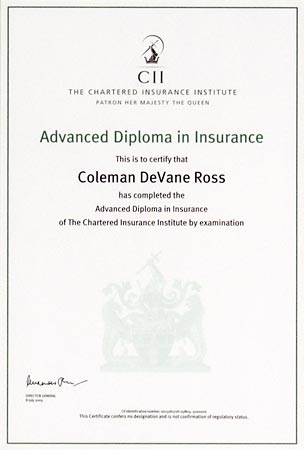

Advanced Diploma in Insurance

Inside the Lloyd's Building

Photo from Wikipedia

I enrolled in the Chartered Insurance Institute's Advanced Diploma in Insurance program when I was the chief financial officer of Trenwick Group and also on the board of directors of its Lloyd's of London syndicate manager. The Chartered Insurance Institute, also based in London, is a professional organization for the insurance and financial services industry. I received my diploma in 2005 after completing examination requirements in the following subjects:

- Risk, Regulation, and Capital Adequacy

- Company and Contract Law and Their Application to Insurance

- Business and Economics

- Principles of Property and Pecuniary Insurance

- Principles of Reinsurance

- Management

- Marketing

- Finance and Accounting

- North American General Insurance Principles

One afternoon in 1637 … a Cretan scholar named Canopius sat down in his chambers at Balliol College, Oxford, and made himself a strong cup of coffee. Canopius's brew is believed to mark the first time coffee was drunk in England; it proved so popular when it was offered to the public that hundreds of coffee houses were soon in operation all over London….

The coffee house that Edward Lloyd opened in 1687 near the Thames on Tower Street was a favorite haunt of men from ships that moored at London's docks…. [Lloyd] was a lot more than a skilled coffee-house host. Recognizing the value of his customer base and responding to the insistent demand for information, he launched "Lloyd's List" in 1696 and filled it with information on the arrival and departure of ships and intelligence on conditions abroad and at sea…. One corner [of his coffee house] was reserved for ships' captains where they could compare notes on the hazards of the new routes that were opening up….

Then, as now, anyone who was seeking insurance would go to a broker, who would then hawk the risk to individual risk-takers who gathered in the coffee houses or in the precincts of the Royal Exchange. When a deal was closed, the risk-taker would confirm his agreement to cover the loss in return for a specified premium by writing his name under the terms of the contract; soon these one-man insurance operators came to be known as "underwriters"…. Lloyd's coffee house served from the start as the headquarters for marine underwriters, in large part because of its excellent mercantile and shipping connections….

In 1771, nearly a hundred years after Edward Lloyd opened his coffee house on Tower Street, seventy-nine of the underwriters who did business at Lloyd's subscribed £100 each and joined together in the Society of Lloyd's, an unincorporated group of individual entrepreneurs operating under a self-regulated code of behavior. These were the original Members of Lloyd's; later, members came to be known as "Names". The Names committed all their worldly possessions and all their financial capital to secure their promise to make good on their customers' losses. That reason was one of the principal reasons for the rapid growth of business underwritten at Lloyd's over the years. And thus did Canopius's cup of coffee lead to the establishment of the most famous insurance company in history.

— Peter L. Bernstein, Against the Gods: The Remarkable Story of Risk

(back to the Education main page)

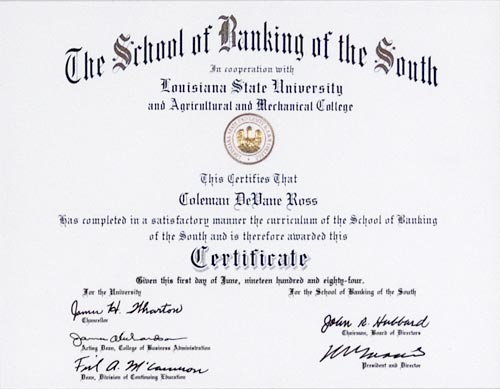

Graduate School of Banking Certificate

Louisiana State University's

Memorial Tower

photo by Kkmurray, Wikipedia

I enrolled in the banking program at the Graduate School of Banking (then the School of Banking of the South) in 1982 at a time when banking was as much a part of my client base as insurance. Virtually all of my classmates there were bankers, which made for some interesting discussions around financial statements, credit analysis, and independent auditors’ reports. The program required attendance and participation at three annual two week on-campus sessions in Baton Rouge with independent projects between years. I graduated from the program in 1984. The topics covered by the program included the following:

- Profit Planning

- Product Pricing

- Consumer Credit

- Real Estate Financing

- Special Banking Issues

- Banking Simulation

- Economics

- Investments

- Credit Analysis

- Marketing

- Law

- Management

There are some who would argue that the role of the bank supervisor is to minimize or even eliminate bank failure, but this view is mistaken, in my judgment. The willingness to take risk is essential to the growth of a free market, capitalist economy…. [I]f all savers and their financial intermediaries invested only in risk-free assets, the potential for business growth would never be realized.

— Former U.S. Federal Reserve Chairman Alan Greenspan

(back to the Education main page)

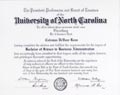

Bachelor of Science in Business Administration

Concentration in

Accounting

I had never been east of Winston-Salem when I first got here.

I was so homesick, I could die.

— Andy Griffith (UNC Class of 1949)

North Carolina has long been identified with enlightened and progressive leaders and people, and I can think of no more important reason for that reputation than this university, which year after year has sent educated men and women who have had a recognition of their public responsibility as well as their private interests…. (T)he graduate of this university is a man of his nation as well as a man of his time. And it is my hope … that this university will still hew to the old line of responsibility that its graduates owe to the community at large – that in your time, too, you will be willing to give to the state and country a portion of your lives and all of your knowledge and all of your loyalty.

— President John F. Kennedy (University Day address at

The

University of North

Carolina, October 12, 1961)

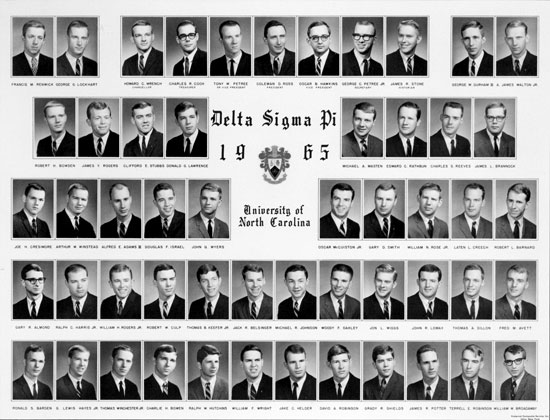

Coleman D. Ross

Class of 1965

I received a BSBA degree with a concentration in accounting from the University of North Carolina at Chapel Hill in 1965, notwithstanding my initial reluctance to study accounting. My father, who had died during my senior year in high school, and my brother were both accountants and I wanted to establish my own, separate identity. Furthermore, the UNC accounting degree program required an additional semester of course work beyond the normal business degree program and cost was a factor, as I was paying for my own education. Despite my need to establish my own identity and the cost of additional study, it became obvious to me that accounting was the right field for me and I completed the program in four years by attending summer school.

1965 UNC Delta Sigma Pi chapter members

Row 1: Marion Renwick, George Lockhart, Howard Wrench,

Charlie Cook,

Tony Petree, Coleman Ross, O.B. Hawkins, G.C. Petree,

Jim Stone,

George Durham, Jim Walton.

Row 2: Bob Bowden, Jim Roberts,

Earl Stubbs,

Don Lawrence, Mike Masten, Ted Rathbun, Steve Reeves,

Jim Brannock.

Row 3: Joe Cresimore, Art Winstead,

Ed Adams,

Doug Israel, John Myers, Tom McCuiston, Gary Smith, Bill Rose,

Laten Creech, Robert Barnard.

Row 4: Gary Almond, Ralph Harris,

Bill Rogers,

Bob Culp, Tom Keefer, Jack Belsinger, Mike Johnson,

Woody Oakley,

Jon Wiggs, John Lomax, Tad Dillon, Fred Avett.

Row 5: Ron Barden, Lewis Hayes,

Page Winchester,

Charlie Bowen, Wayne Hutchins, Fletcher Wright, Jake Helder,

Dave Robinson,

Grady Shields, Jim Potter, Terry Robinson, Bill Broadway.

Not pictured: Arthur Burgess, Jerry Craig,

Bob Mullinax,

Charlie Parker

I benefited greatly from the accounting education that I received from UNC. I benefited even more from my financial and leadership responsibilities. I worked at part-time jobs during the school terms and also worked at a full-time job on school breaks. With these jobs and loans from an aunt, I ultimately paid all of the costs of my undergraduate education. I was also active in Delta Sigma Pi business fraternity and was President of the chapter in my senior year. These financial and leadership responsibilities were as important as academics in defining me and laying the foundation for my subsequent careers.

My BSBA degree required the completion of 46 courses and 140 semester hours, including ten accounting courses, seven economics and finance courses, two law courses, and six other business administration courses in areas of management, marketing, and human resource administration. In 1967, I also completed yet another undergraduate accounting course at the University of South Florida, which was a specific requirement for me to obtain a Florida CPA license. My undergraduate Business Administration course work follows:

Accounting courses

- Elementary Accounting Principles

- Intermediate Accounting Principles

- Advanced Accounting Principles

- Advanced Accounting Problems

- Cost Accounting

- Accounting Theory

- Auditing

- Federal and State Income Taxation for Individuals

- Federal and State Income Taxation for Partnerships and Corporations

- Certified Public Accounting Problems

- Governmental Institution Accounting (University of South Florida)

Law and Other Business Administration courses

- Business Law

- Credit Transactions and Sales

- Principles of Management

- Management Controls

- Personnel Relations

- Principles of Marketing

- Operations Research

- Management Simulation

Economics and Finance courses

- Microeconomics

- Macroeconomics

- Statistics

- Money and Banking

- Business Finance

- Cases in Business Finance

- Government and Business

I am blessed to have gone to school here for four years. You are blessed for the same reason. You won't realize the depth of it until later in life, which is natural. There is something about this campus – the tradition here, the social life, the athletics, the academics, the pride of being a Tar Heel.

— Stuart Scott (UNC Class of 1987 and former ESPN Sports Center anchor;

May 2001 Commencement address)

(back to the Education main page)

CERT Certificate in

CERT Certificate in

Cybersecurity Oversight

We see vividly – painfully – how technology can harm rather than help. Platforms and algorithms that promised to improve our lives can actually magnify our worst human tendencies.

— Tim Cook, Apple Corporation Chief Executive Officer

![]() The National Association of Corporate Directors’ Cyber Risk Oversight Certificate course is considered the premier credential for directors. The online, self-paced course was developed to:

The National Association of Corporate Directors’ Cyber Risk Oversight Certificate course is considered the premier credential for directors. The online, self-paced course was developed to:

- enhance a director’s understanding of the cybersecurity threat landscape,

- detail the respective responsibilities of the board and management in cyber-risk oversight,

- lead a director through a cyber-crisis simulation to evaluate an organization’s preparedness, and

- offer a tangible credential for a director to demonstrate his or her commitment to advanced cyber-risk oversight.

The course was developed for the NACD by Carnegie Mellon University’s Software Engineering Institute, CERT Division, and is accredited by the NACD for 22 credit hours towards maintaining my NACD Fellowship designations.

The course was developed for the NACD by Carnegie Mellon University’s Software Engineering Institute, CERT Division, and is accredited by the NACD for 22 credit hours towards maintaining my NACD Fellowship designations.

The course is divided into the following seven modules:

- NACD Welcome: NACD Director’s Handbook with April 2018 and October 2018 updates, directors and officers insurance concerns

- Cybersecurity Oversight for Directors – Program Overview

- Overview of Cybersecurity Leadership: cybersecurity principles, cybersecurity governance, cyber-risk and resilience management – risk management overview, operational risk and resilience, critical assets and processes, threats and vulnerabilities identification, risk and impact analysis determination, risk mitigation and risk assessment, cyber threats and vulnerabilities, cybersecurity controls – control types and method, selecting cybersecurity controls, cybersecurity testing, incidence response, business continuity and disaster recovery, cybersecurity resources

- Effective Security Structure and Operations: security structure, planning, and operations; planning, strategizing, and managing for the security team, alignment with business objectives and goals, cybersecurity enforcement and training, security investment and measurement, cybersecurity metrics

- Cybersecurity Oversight for Directors: setting the tone at the top and allocating oversight responsibilities, cyber-risk oversight as a fiduciary duty, disclosure issues, understanding liability, board communications with the Chief Information Security Officer and senior management Cyber-Crisis Simulation Exercise: simulation exercise

- Cyber-Crisis Simulation Exercise: simulation exercise

- Summary of Cybersecurity Oversight for Directors

I completed this program in June 2020.

Given the significant cyber-attacks that are occurring with disturbing frequency, and the mounting evidence that companies of all shapes and sizes are increasingly under a constant threat of potentially disastrous cyber-attacks, ensuring the adequacy of a company’s cybersecurity measures needs to be a critical part of a board of director’s risk oversight responsibilities.

— Luis A. Aguilar, SEC Commissioner

We discovered in our research that insider threats are not viewed as seriously as external threats, like a cyberattack. But when companies had an insider threat, in general, they were much more costly than external incidents. This was largely because the insider that is smart has the skills to hide the crime, for months, for years, sometimes forever.

— Dr. Larry Ponemon, Chairman and Founder,

Ponemon Institute

(back to the Education main page)

Cybersecurity Fundamentals for Financial

and Accounting Professionals Certificate

Breaking news about malware attacks, phishing scams, system hacks, and identity theft have become commonplace in today’s headlines. Cybersecurity threats are escalating, unnerving boards of directors, managers, investors, and other stakeholders of public and private organizations of all sizes. These organizations are under increasing pressure to demonstrate that they are managing threats, and that they have effective processes and controls in place to detect, respond to, mitigate, and recover from security incidents that could disrupt their business, result in financial loss, and destroy their reputation.

— American Institute of CPAs

NIST Cybersecurity Framework

Five Functions

National Institute of Standards and Technology

The AICPA's Cybersecurity Fundamentals for Financial and Accounting Professionals Certificate program is a comprehensive, on-demand learning experience covering the fundamental concepts of cybersecurity. In connection with my broad governance and specific audit committee roles at both Pan-American Life and Syncora Financial, I used the certificate program to broaden and strengthen my cybersecurity knowledge.

This program is approved for 15.5 hours of continuing education credits for CPAs by the National Association of State Boards of Accountancy (NASBA). The four courses in the program, which I completed in May 2019, follow:

Cybersecurity Terminology, Transformation, and Threat Landscape

This 4.5-hour course introduced key terms related to cybersecurity, the effect of digital transformation on business and how it relates to cybersecurity, and major areas of technology that are disrupting organizations.

Cybersecurity Frameworks

This 5.0-hour course introduced the available cybersecurity frameworks and their use. It also thoroughly explored the US Department of Commerce’s National Institute of Standards and Technology (NIST) Cybersecurity Framework and its five functions: identify, protect, detect, respond, and recover.

Cybersecurity Risk Management Program and the Description Criteria

This 3.5-hour course explored the importance of a fully developed cybersecurity risk management program focusing on the American Institute of CPAs’ Description Criteria for Management’s Description of the Entity’s Cybersecurity Risk Management Program and the implementation guidance provided for the 19 description criteria or benchmarks within these categories: nature of business and operations, nature of information at risk, cybersecurity risk management program objectives, factors that have a significant effect on inherent cybersecurity risks, cybersecurity risk governance structure, cybersecurity risk assessment process, cybersecurity communications and quality of cybersecurity information, cybersecurity risk management program monitoring, and cybersecurity control process.

The Business of Cybersecurity

This 2.5-hour course explored the business of cybersecurity, including costs and risk transfer through cybersecurity insurance, as well as provides an overview of cybersecurity organizational structures, types of information system security professionals, and cybersecurity services, such as readiness assessments, penetration testing, digital forensic services, and the American Institute of CPAs’ System and Organization Controls (SOC) for Cybersecurity examination engagement.

The learning objectives for this program follow:

- The importance of cybersecurity to the accounting and finance professional and his or her organization.

- What it takes to develop a security mindset to be a trusted adviser and key contributor to cybersecurity risk management.

- Key cybersecurity terminology to enable the accounting and finance professional to converse and collaborate with other functional leaders, employees, and vendors.

- The effect of digital transformation on cybersecurity.

- Cybersecurity threats, attacks, data breach implications, and privacy considerations.

- Security frameworks and applicable regulations for an organization or client.

- The importance of the AICPA cyber security risk management reporting framework.

- Controls to mitigate cybersecurity risks.

- Financial and operational implications of cybersecurity.

In addition to this AICPA certificate program, in June 2019, I also attended EY's Cybersecurity Board Summit 2019: Putting Governance to Work, in Dallas, Texas, which was approved for 8.0 hours of continuing education credit for CPAs covering the following topics:

- Lessons Learned from Attacks on Companies, from the First Detection of a Breach to the Resolution of Legal Exposure

- Trust by Design – Building Cyber Resiliency from the Beginning

- Responding to a Simulated Cyber Breach

- The SEC’s Perspective on Cybersecurity Governance

- Responding to and Recovering from a Cyber Breach

- Leading Practices for Cyber Oversight

Every case involving cybercrime that I’ve been involved in, I’ve never found a master criminal sitting somewhere in Russia or Hong Kong or Beijing. It always ends up that somebody at the company did something they weren’t supposed to do. They read an email, went to a website they weren’t supposed to.

— Frank Abagnale

Author, “Catch Me If You Can”

(back to the Education main page)

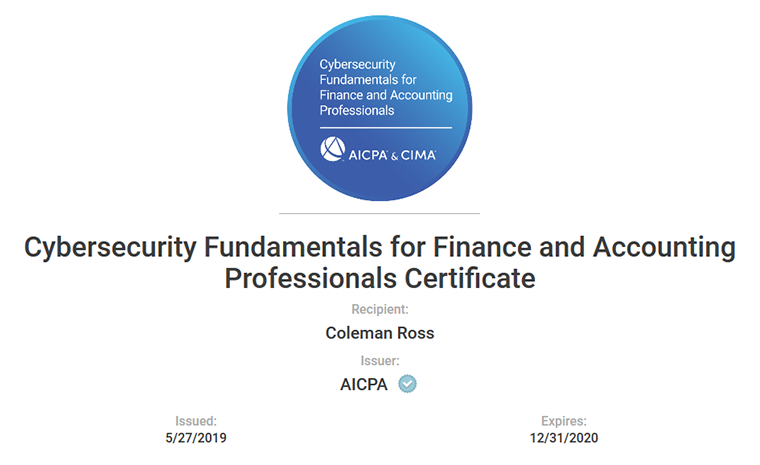

Certificate of Director Education

Directors of Pan-American Life

Photo courtesy of Pan-American Life

In support of my role as an independent director, I completed the National Association of Corporate Directors' two-day Director Professionalism program and received the Certificate of Director Education in June 2008. The NACD is the membership organization dedicated to serving the corporate governance needs of corporate directors and boards. The organization’s professionalism course that I completed covered the following curriculum topics:

- Board excellence: roles, responsibilities, structure, and leadership

- Fiduciary duties of corporate boards

- Scrutinizing financial statements: knowing what questions to ask management and auditors

- Creating and sustaining board value: corporate strategy and risk oversight

- Board governance and the role of the Governance and Nominating Committee

- Audit Committees: effectiveness in the new environment

- Executive and director compensation in the changing landscape

- A case study on risk management

The long-recognized challenge, of course, is that the interests of management are not always completely aligned with those of the shareholders. In 1776, Adam Smith wrote about the agency problem of management in the Wealth of Nations: when it comes to money, he said, managers "cannot well be expected that they should watch over it with the same anxious vigilance with which the partners in a private [partnership] frequently watch over their own". There, "negligence and profusion must always prevail, more or less, in the management of the affairs of such a company". In the face of such potential for managers' conflicts of interest, directors must guard the interests of shareholders and ensure that managers do their jobs. They also must perform an extremely important advisory role to management. The widespread dispersion of ownership in a modern corporation makes the role of directors all the more important.

— SEC Commissioner Paul S. Adkins,

"Remarks at the Corporate Directors Forum",

January 22, 2007

(back to the Education main page)

CFA Institute

Investment

Foundations Certificate

In recent years, annual trading in stocks – necessarily creating, by reason of the transaction costs involved, negative value for traders – averaged some $33 trillion. But capital formation – that is, directing fresh investment capital to its highest and best uses, such as new businesses, new technology, medical breakthroughs, and modern plant and equipment for existing business – averaged some $250 billion. Put another way, speculation represented about 99.2 percent of the activities of our equity market system, with capital formation accounting for 0.8 percent.

— John C. Bogle, Founder and Former Chairman of The Vanguard

Group,

The Clash of the Cultures: Investment vs. Speculation

Inside the New York Stock Exchange

Photo from Wikipedia

The CFA Institute Investment Foundations Certificate (formerly Claritas Investment Certificate)

program is a comprehensive global education program offered by the CFA Institute that gives

financial services professionals a clear understanding of the essentials of the investment industry.

The CFA Institute Investment Foundations Certificate (formerly Claritas Investment Certificate)

program is a comprehensive global education program offered by the CFA Institute that gives

financial services professionals a clear understanding of the essentials of the investment industry.

I enrolled in the program in January 2016 to broaden and deepen my investment-related knowledge and in support of my board responsibilities. I completed the program in July 2016. The Institute estimated that the self-study program requires approximately 100 hours of examination preparation time. The Institute's examination covers the fundamentals of the investment industry across seven course modules and 20 topics within those modules:

Industry Overview

- The investment industry: a top-down view

Ethics and Regulation

- Ethics and investment professionals

- Regulation

Inputs and Tools

- Microeconomics

- Macroeconomics

- Economics of international trade

- Financial statements

- Quantitative concepts

Investment Instruments

- Debt securities

- Equity securities

- Derivative instruments

- Alternative investments

Industry Structure

- Structure of the investment industry

- Investment vehicles

- The functioning of financial markets

Serving Client Needs

- Investors and their needs

- Investment management

Industry Controls

- Risk management

- Performance evaluation

- Investment industry documentation

Successful investing takes time, discipline, and patience. No matter how great the talent or effort, some things take time. You can't produce a baby in one month by getting nine women pregnant.

— Berkshire Hathaway Chairman Warren Buffett

(back to the Education main page)

Blockchain Fundamentals for Accounting

Blockchain Fundamentals for Accounting

and Finance Professionals Certificate

Blockchain technology isn’t just a more efficient way to settle securities. It will fundamentally change market structures, and maybe even the architecture of the Internet itself.

— Abigail Johnson

Fidelity Investments president

and chief executive officer

Blockchain is so versatile that besides recording financial transactions, it can be used for storing medical records, tracking the flow of goods, concluding binding agreements, storing personal credit records, and much more.

— American Institute of CPAs

The AICPA’s Blockchain Fundamentals for Accounting and Finance Certificate program is a comprehensive, on-demand learning experience covering the fundamental concepts of blockchain. In connection with my broad governance and specific audit committee roles at Pan-American Life, I used the certificate program to broaden and strengthen my blockchain knowledge.

This program is approved for 16.0 hours of continuing education credit for CPAs by the National Association of State Boards of Accountancy. The nine courses in the program, which I completed in April 2020, follow:

Blockchain Evolution and Technology Concepts

Blockchain technology is in a period of exceptional growth, and the accounting profession will play a significant role in driving its adoption. This 3.5-hour course makes the participant be a part of the blockchain evolution. Starting with a focus on the history and evolution of blockchain and bitcoin and then on to the characteristics of bitcoin, you will get a refresher on the fundamentals of money/currency and learn how bitcoin fits into the global business landscape.

Blockchain: Using and Securing Cryptocurrencies

This 2.0-hour course focuses on an overview of securing cryptocurrency. It covers wallets that are the fundamental security concept for cryptocurrencies and the most important aspect of this new technology for accountants and auditors to understand. It dives into the relationship that exists between physical and digital security. In addition, the participant learns the importance of password managers, which are web-based tools for storing and encrypting data.

This 2.0-hour course focuses on an overview of securing cryptocurrency. It covers wallets that are the fundamental security concept for cryptocurrencies and the most important aspect of this new technology for accountants and auditors to understand. It dives into the relationship that exists between physical and digital security. In addition, the participant learns the importance of password managers, which are web-based tools for storing and encrypting data.

Blockchain: Benefits, Values, and Opportunities

This 2.0-hour course focuses on many of the benefits, values and opportunities that arise with the emergence of blockchain technology. It dives into the four characteristics of the bitcoin blockchain: censorship resistance, borderless, neutral and open. It expands on a use case for blockchain, supply chain. In addition, the participant covers industry-specific applications, such as healthcare, accounting, tax and legal.

Risks and Challenges of Blockchain

This 1.5-hour course focuses on blockchain and cryptocurrency risks and covers the emergence of new risks that did not exist in the traditional business models. The participant explores key management risk, wallet and code risk, fork and chain split risk, consensus risk, legacy risk and fungibility risk. In addition, this webcast expands on regulatory concerns and standards related to cryptocurrencies.

Blockchain Trends (1.5 hours)

This 1.5-hour course focuses on the trends for the blockchain technology and expands on scaling as a major focus for new and existing blockchains. It describes how many innovations are making financial transactions easier and how accounting and auditing may see more challenges. In addition, it focuses on the swing towards blockchain interdependence.

Permissioned Ledgers and Other Solutions

Blockchain is disrupting the accounting and finance professions. In this 1.0-hour course, the participant learns how professionals can incorporate permissioned ledgers and blockchain solutions into their everyday work. This course expands on the effects on internal controls and segregation of duties and how they are becoming much more technological in nature, which will affect the way that professionals perform their procedures. In addition, the participant dives into blockchain-as-a-service solutions and the shift related to the assurance and financial statement preparation procedures.

Transactions and Smart Contracts

The participant becomes part of the blockchain evolution with this 1.5-hour course, which introduces several key concepts related to transactions and smart contracts. The course discusses the transaction throughput, transaction fees, gas (i.e., Ethereum transaction fees), and confirmations. Also, the participant learns how to apply metrics for traditional financial system to blockchain in a way that allows others to understand the capacity of a given blockchain.

The Blockchain Landscape

This 1.5-hour course focuses on the blockchain landscape, which enables users to have a framework for researching and understanding the technology from an investor and professional viewpoint. It expands on different types of crypto-asset exchanges as well as initial coin offerings. In addition, this webcast reviews different approaches to applying blockchain technologies in order to create new business solutions.

Blockchain – Process and Technical Controls

In this 1.5-hour course, the participant explores process controls and service organization controls in the blockchain context. By exposing the opportunities and challenges of this new technology, this webcast teaches the participant how to verify important process controls. Additionally, the participant learns how the CPA’s role and duties will change because of blockchain application.

The learning objectives of this program follow:

- Identify the basic concepts of blockchain technology.

- Recognize a range of cases for using and securing crypto/digital assets.

- Identify the various opportunities associated with blockchain technology.

- Identify the elements, benefits, and risks of permissioned ledgers.

- Identify the risks and challenges of blockchain technology.

- Recognize the effect of the various controls associated with blockchain.

- Recognize recent blockchain trends and their potential effect to the accounting and finance profession.

Following completion of the AICPA’s Blockchain Fundamentals for Accounting and Finance Professionals Certificate program, I also completed two other online AICPA blockchain courses, Blockchain for Insurance and Blockchain for Healthcare. These two courses, each accredited for 5.0 hours of continuing education for CPAs, covered how blockchain will affect the insurance and healthcare industries. Following an overview of blockchain for each industry, the courses presented blockchain use cases for insurance (property and casualty insurance, life insurance, and reinsurance) and healthcare (patient data management, drug traceability, and healthcare data management) and emerging and future trends of blockchain for each industry.

The learning objectives for these programs follow:

- Distinguish the potential effect of blockchain on each industry.

- Identify the opportunities and benefits created by blockchain implementation.

- Analyze the challenges and risks of blockchain adoption.

- Examine the financial, organizational, and regulatory consequences of blockchain adoption.

- Identify the importance of blockchain trends and developments to the future.

In addition, I completed an online topic course, Blockchain and the Insurance Industry, offered by The Institutes (formerly the Insurance Institute of America and the American Institute of Chartered Property Casualty Underwriters). The course covered four topics: blockchain overview and benefits; blockchain, cryptocurrency, and smart contracts; business applications of blockchain; and insurance applications of blockchain and was accredited for 6.0 hours of continuing education for CPCUs.

Blockchain is the financial challenge of our time. It is going to change the way our financial world operates

-- Blythe Masters, former Hyperledger

Project board chair and former Digital

Asset chief executive officer

Over the next decade, there will be disruption as the Internet was for publishing, where blockchain is going to disrupt dozens of industries, one being capital markets and Wall Street.

-- Patrick M. Byrne, former

Overstock.com chairman and chief

executive officer

(back to the Education main page)

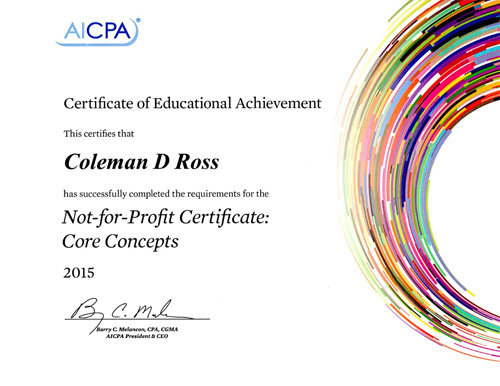

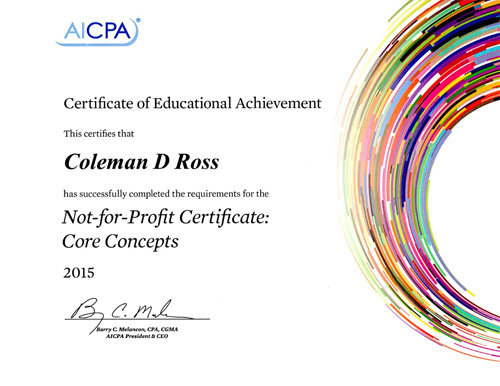

Not-for-Profit Certificates

I think the character that you learn in Scouting – working together, being honest with each other, being close knit … and depending on one another, on our camping trips and doing things – all these things build character in a young man that he takes with him into adulthood and makes him a better citizen. And that's why Scouting to me has always been an organization I've wanted to help. I think it's one of the best youth organizations that we have … in this country.

— James Lovell, Eagle Scout and Apollo 13 Astronaut

Beyond the Easel" by Norman Rockwell from a 1969 Boy Scouts of America calendar published by Brown & Bigelow

Photo from Wikipedia

The AICPA's Not-for-Profit Certificate programs are comprehensive, on-demand learning experiences covering the core concepts of accounting and financial reporting, tax compliance, and governance and assurance. In connection with my governance, accounting, and audit committee roles at national, regional, and local levels within the Boy Scouts of America, I used the two certificate programs to broaden and strengthen my not-for-profit accounting and financial reporting knowledge.

I enrolled in the first program in July 2015, which I completed in December 2015. This program is approved for 40 hours of continuing education credits for CPAs by the National Association of State Boards of Accountancy (NASBA). The four areas and 24 courses in the first program follow:

- Introduction to not-for-profit entities: accounting, tax, and compliance essentials (one course)

- Accounting and financial reporting: generally accepted accounting principles for not-for-profit entities, financial statement presentation, assets, investments, programmatic investments, split-interest agreements and endowments, liabilities, fair value issues specific to not-for-profit entities, net assets, revenue from contributions, exchange and agency transactions, and expenses (12 courses)

- Tax compliance: tax-exempt status, unrelated business income, introduction to Form 990, federal and state filing requirements, and private foundations (five courses)

- Governance and assurance: best practices in board governance; financial oversight, budget, and strategy; risk assessment and internal controls; fraud oversight and prevention; planning the audit engagement; and auditing considerations (six courses)

I later enrolled in the second program in January 2017, which I completed in September 2018. This program is approved by for 30 hours of continuing education credit for CPAs by the NASBA. The three areas and 17 courses in the second program follow:

- Accounting and financial reporting: preparing consolidates financial statements, statement of financial position, statement of activities, statement of cash flows, statement of functional expenses, financial statement note disclosures, and interpreting and analyzing financial statements (seven courses)

- Tax compliance: Form 990 preparation – core form, Form 990 preparation – schedules, maintaining tax exemption, and unrelated business income tax (UBIT) case studies (four courses)

- Governance and assurance: aligning mission and strategy, performance measurement, risk assessment, ethical issues, applying the COSO enterprise risk management framework, and budgeting considerations (six courses)

I think that American leadership is vital to peace and prosperity and the advancement of democracy in the world, and that requires having strong leaders. And I don't think there's any organization in the world, certainly not in the United States, that better prepares young men for leadership in this country than the Boy Scouts of America – in teaching leadership skills, in teaching values, in teaching importance of standing up for what's right.

— Robert Gates, Eagle Scout,

former Secretary of Defense and

Director of the Central Intelligence Agency,

and President of the Boy Scouts of

America

(back to the Education main page)

High School Diploma

A person's character traits are not developed in isolation, but within and by the communities to which he belongs

— Aristotle

Coleman D. Ross

Class of 1961

Pleasant Garden School Auditorium

painting by Sandra Melvin Gray, PGHS Class of 1961

Pleasant Garden High School Class of 1961

Beth Allred, Evonne Allred, Christine Arnold, Dewitt Austin, Phil Boyce, Sam Brogden, Linda Brown, Dale Chandler, Larry Coble, Nancy Cox, Sue Culbreth, Nancy Dominick, Jack Fields, June Fields, Larry Fields, John Glass, Linda Hemphill, Rena Hinshaw, Brenda Hockett, Nelson Ingram, Roger Jordan, Linda Kinley, Garland Kirkman, Joyce Kirkman, Martha Ross Kirkman, Sue Kirkman, Bobbie Latham, Ivey Lasley, Jeanette Marley, Teresa McInnis, Jerry Monnett, Brenda Moran, Kenneth Mowery, Kenton Oliver, Bill Osborne, Ronald Osborne, Howard Pratt, Brenda Reddick, Larry Reynolds, Sue Riley, Coleman Ross, Gladys Rummage, Barbara Saunders, Brenda Smith, Fred Smith, Jane Smith, Anne Still, Robert Taylor, Charlotte Toomes, Hal Toomes, Jenny Varner, Larry Walton, Sandra Willard, Gary Wood.

Not pictured: Buddy Allred, Kathy Taylor Beane, Steve Burton, Bill Garrett, Doris Ingold, Sandra Melvin, Gilbert Peele, Ron Stevens, Sonja Allred Still

Pleasant Garden High School Class of 1961 50th Anniversary Reunion

Buddy Allred, Linda (Brown) Ayers, Alice (Thompson) Beane, Phil Boyce, Steve Burton, Dale Chandler, Mona (Tart) Crawford, June (Fields) Dean, Brenda (Smith) Fields, Larry Fields, Harvey Harrison, Rena Hinshaw, Nelson Ingram, Linda (Hemphill) Land, Jerry Monnett, Billie (Latham) Mounce, Kenneth Mowery, Edwin Myers, Martha Ross (Kirkman) Nichols, Kenton Oliver, Jeanette (Marley) Osborne, Evonne (Allred) Parks, Sue (Kirkman) Pine, Howard Pratt, Anne (Still) Ross, Coleman Ross, Sandra (Willard) Still, Barbara (Saunders) Taylor, Brenda (Reddick) Taylor, Robert Taylor, Gladys (Rummage) Tidwell, Doris (Ingold) Vaughn, Gary Wood.

Not pictured: Kathy (Taylor) Beane, Sam Brogden, Larry Coble, Nancy (Cox) Coble, Nancy Dominick, Jack Fields, Jane (Smith) Fowler, John Glass, Sandra (Melvin) Gray, Christine (Arnold) Hasty, Charlotte (Toomes) Hatschek, Sue (Riley) Jones, Roger Jordan, Garland Kirkman, Ivey Lasley, Brenda Moran, Bill Osborne, Ronald Osborne, Gilbert Peele, Sue (Culbreth) Persons, Theresa (McInnis) Pruitt, Fred Smith, Sonja Allred Still, Linda (Kinley) Sugg, Beth (Allred) Walton, Larry Walton.

Deceased: Dewitt Austin, Bobbie (Latham) Bristow, Jenny (Varner) Burton, Bill Garrett, Larry Reynolds, Joyce (Kirkman) Russell, Ron Stevens, Brenda (Hockett) Tatum, Hal Toomes

photo by Charles Osborne

Pleasant Garden High School Class of 1961 Reunion on June 22, 2019

Linda (Brown) Ayers, Alice (Thompson) Beane, Steve Burton, Brenda (Smith) Fields, Rena Hinshaw, Nelson Ingram, Roger Jordan, Garland Kirkman, Clifford Lewis, Jerry Monnett, Edwin Myers, Kenton Oliver, Jeanette (Marley) Osborne, Ronald Osborne, Evonne (Allred) Parks, Larry Patton, Sue (Culbreth) Persons, Howard Pratt, Anne (Still) Ross, Coleman Ross, Fred Smith, Linda (Kinley) Sugg, Brenda (Reddick) Taylor, Gladys (Rummage) Tidwell, Pat (Moser) Waugh, Gary Woods.

Not pictured: Kathy (Taylor) Beane, Phil Boyce, Dale Chandler, Nancy (Cox) Coble, Mona (Tart) Crawford, June (Fields) Dean, Nancy Dominick, Jack Fields, John Glass, Sandra (Melvin) Gray, Christine (Arnold) Hasty, Charlotte (Toomes) Hatschek, Ivey Lasley, Brenda Moran, Billie (Latham) Mounce, Martha Ross (Kirkman) Nichols, Bill Osborne, Gilbert Peele, Sue (Kirkman) Pine, Sandra (Willard) Still, Doris (Ingold) Vaughan, Beth (Allred) Walton, Larry Walton.

Deceased: Buddy Allred, Dewitt Austin, Bobbie (Latham) Bristow, Sam Brogdon, Jenny (Varner) Burton, Larry Coble, Larry Fields, Jane (Smith) Fowler, Bill Garrett, Sue (Riley) Jones, Linda (Hemphill) Land, Theresa (McInnis) Pruitt, Larry Reynolds, Joyce (Kirkman) Russell, Ron Stevens, Sonja (Allred) Still, Brenda (Hockett) Tatum, Barbara (Saunders) Taylor, Robert Taylor, Hal Toomes.

photo by Charles Osborne

I was born and raised in Pleasant Garden, North Carolina, where I attended Pleasant Garden School for 12 years. I took college preparatory courses at Pleasant Garden High School (now Southeast Guilford High School), was a member of the Beta Club, the school’s honor society, and graduated third in my class of 61 students.

I also participated in basketball and track, as well the high school chorus. I played basketball all four years and was a distance runner on the track team my final two years. In 1960, I finished in first place in the 880 yard (half-mile) run in the Guilford County Track and Field Championship Meet. In addition to the high school chorus, I also sang in the statewide North Carolina Choral Festival. Following my high school junior year, I was one of two participants from my school in Tar Heel Boys’ State, a week-long, statewide program held in Chapel Hill at UNC. In my senior year of high school, I received the Civitan Award from the Civitan Club of Greensboro, being voted by my fellow high school students as the best citizen in the senior class.

We can't turn back the days that have gone. We can't turn life back to the hours when our lungs were sound, our blood hot, our bodies young. We are a flash of fire – a brain, a heart, a spirit. And we are three-cents-worth of lime and iron – which we cannot get back.

— Thomas Wolfe (UNC Class of 1920), Look Homeward, Angel

(back to the Education main page)